Laura DiMugno, 7 June 2012 (North American Windpower)

“…According to the [Levelinbg the Playing Field; The Case for Master Limited Partnerships by SMU’s Maguire Energy Institute], federal tax-code restrictions currently limit investment in renewable energy infrastructure by $5 billion to $6 billion while, at the same time, prohibiting thousands of jobs from being created. “If the federal production tax credit for wind energy is not renewed beyond the end of this year, up to $15 billion in private investment could disappear. Absent support for renewables at the federal level, the market will have to find other ways to keep the industry afloat and the capital flowing…One way to secure that investment could be through master limited partnerships (MLPs), in which regular investors are allowed to purchase shares in publicly traded partnerships just like stock shares. MLPs have been a key investment tool in the oil and gas industries since the 1980s, but they are not currently available to renewables such as wind power.”

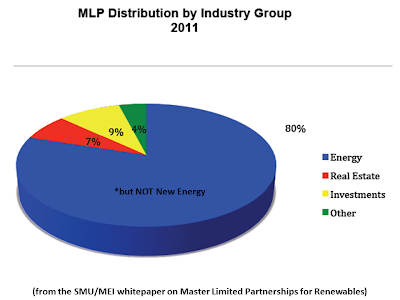

“MLPs have been quite successful in the energy sector, and as a result, their use has increased dramatically over the past couple of decades. According to the report, in 1996, there were just 12 MLPs, with a market capitalization of about $8 billion. By 2011, those numbers had grown to 75 MLPs representing over $270 billion in market capitalization…Eighty percent of MLPs are in the energy sector, according to the report, but renewables are currently excluded [and it would take congressional action to modify the current tax structure to make this new opportunity available to them]. “The study’s authors used financial modeling to expand the MLP structure to include renewable energy, and the results were astounding: Opening up MLPs to renewables could lead to an additional $3.2 billion to $5.6 billion in investment between now and 2021…MLPs are a strong fit for renewable energy investments because power purchase agreements for wind and solar projects are generally long-term contracts that offer cash flow stability…MLPs could also encourage utilities to invest in renewables, because MLPs currently trade higher than traditional utility stocks...”

click to enlarge

click to enlarge

0 comments:

Post a Comment